Stellantis N.V. (NYSE:STLA) ranks among the best undervalued European stocks to buy now. On February 3, Morgan Stanley lowered Stellantis N.V. (NYSE:STLA) from Overweight to Equalweight while lifting the price target to EUR9.20 from EUR8.50. The change comes after Morgan Stanley described Stellantis N.V. (NYSE:STLA) as “the European company lagging behind on investments, product pipeline, market share, margins, FCF, and leverage,” leading to lower earnings and less reliable balance sheet indicators compared to volume peers.

Even with these worries, the firm said that Stellantis N.V. (NYSE:STLA) has witnessed considerable underperformance compared to European automakers, and its product selection is improving gradually, which might lead to gains in the United States along with other markets.

The firm highlighted that Stellantis’ exposure to US markets provides a structural long-term benefit, as the market “should continue to be more protected from China competition for a while,” which Morgan Stanley characterized as its top priority in the volume area.

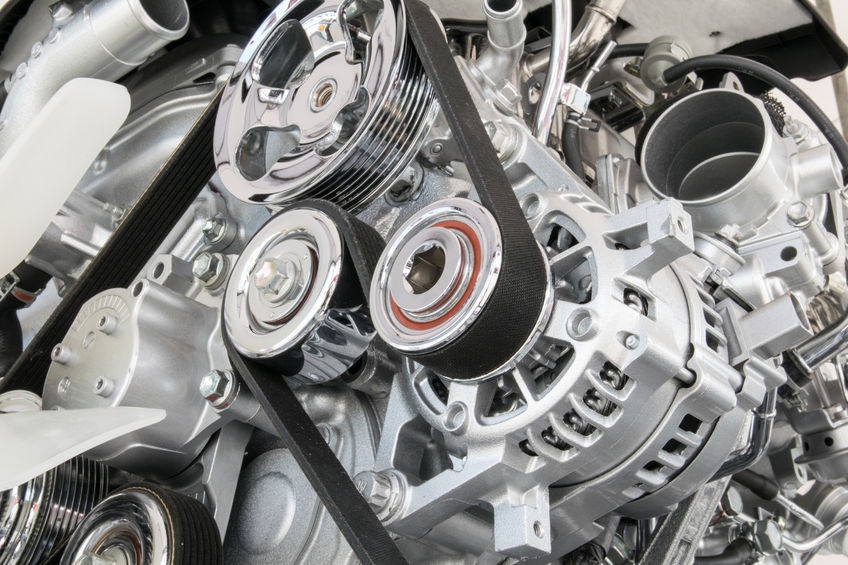

Stellantis N.V. (NYSE:STLA) designs, engineers, manufactures, distributes, and sells cars, light commercial vehicles, engines, transmission systems, and mobility services worldwide.

While we acknowledge the potential of STLA as an investment, we believe certain AI stocks offer greater upside potential and carry less downside risk. If you’re looking for an extremely undervalued AI stock that also stands to benefit significantly from Trump-era tariffs and the onshoring trend, see our free report on the best short-term AI stock.

READ NEXT: 10 Best Magic Formula Stocks for 2025 and 10 Best Retirement Stocks to Buy According to Hedge Funds.

Disclosure: None. This article is originally published at Insider Monkey.