(Bloomberg) — To see how the “T-bill-and-chill” mindset is reshaping fixed-income investing, look no further than the diverging fortunes of two BlackRock Inc. exchange-traded funds.

Most Read from Bloomberg

The phrase captures a preference for short-term government debt in the aftermath of the Federal Reserve’s most aggressive rate hiking cycle in decades — a strategy that delivers steady income without exposure to the monetary-driven whiplash of longer-maturity Treasuries.

One fund has emerged as a haven for cautious cash holders. The other continues to fall out of favor.

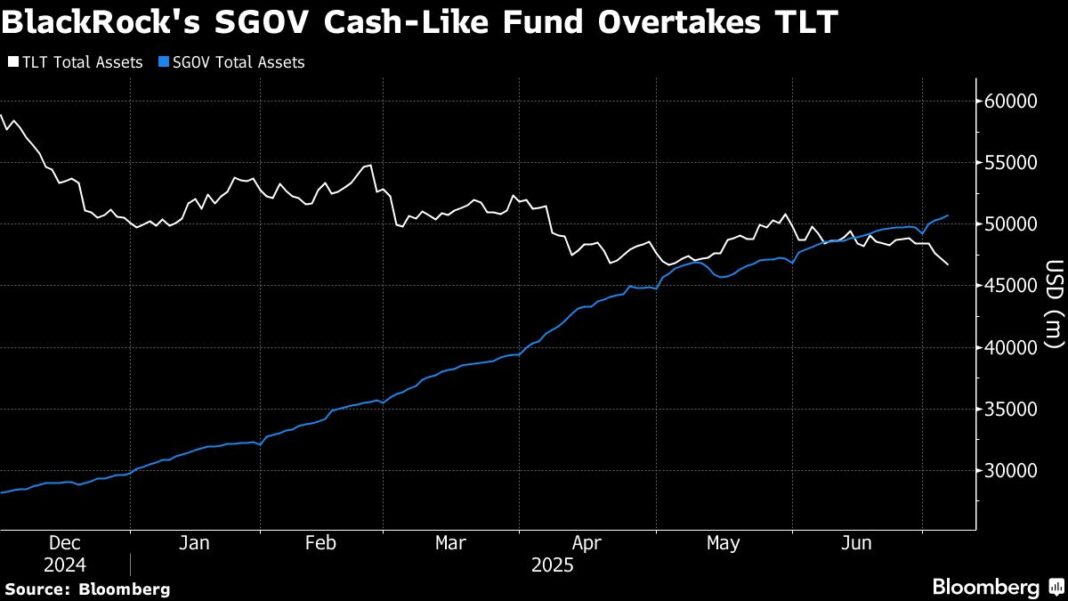

The iShares 0-3 Month Treasury Bond ETF — a five-year-old fund with the ticker SGOV — now manages over $50 billion in assets, more than the iShares 20+ Year Treasury Bond ETF, or TLT. Launched in 2002, the TLT fund — still the most traded bond ETF — had been popular among those seeking to bet aggressively on ups and downs of interest rate moves.

The shift reflects how ETF investors are embracing short-term debt that offers reliable yield with minimal volatility, while stepping away from hard-to-price risks tied to the path of monetary policy years out.

With the Federal Reserve holding rates steady and inflation still sticky, many are content to sit in cash and earn more than 4%. Over the past five years, SGOV has delivered modest but consistent gains, while TLT — despite drawing tens of billions in inflows — has lost roughly 40% in value, earning its reputation as the “widow maker” of the ETF world.

“That preference for lower vol, stable income is growing,” said Todd Sohn, senior ETF strategist at Strategas. “Many investors are now realizing the large amount of volatility that comes with being on the long-end of the curve.”

BlackRock’s cash-like ETF ranks among the top funds by inflows in 2025, and a similar fund from State Street Corp. hit a record in assets earlier this year. The allure of cash also helped boost money market fund assets to a record above $7 trillion.

The tilt toward cash and short-term notes is partially driven by skepticism that long-duration bonds offer enough extra yields to justify the risks — from persistent inflation to growing concerns about the US’ fiscal health. Thirty-year bonds tumbled on Tuesday, pushing yields toward 5% for the first time since May, after President Donald Trump signed a $3.4 trillion budget bill into law last week.